Facts About Three Things To Avoid When You File Bankruptcy Revealed

Immediately after thinking of the impression of organization bankruptcy with your credit rating score, it is necessary to take a look at possibilities to bankruptcy that may enable you to avoid even more monetary worries. Credit card debt consolidation and negotiation is often viable choices to handle your debts without resorting to bankruptcy.

Obtain a deal. You shouldn’t operate using a credit card debt settlement enterprise unless you have a in-depth contract. If you don’t comprehend it, then timetable a meeting with a legal professional who will let you. Generally hold a signed copy with the deal in your information.

Desire will not accrue by using a forbearance. Despite the fact that these are typically not good lengthy-phrase methods, they're able to offer you short term respiration room to tackle other debts.

Yet bankruptcy is filed by people countless A huge number of periods every year. Right here’s a phase-by-move system for individuals serious about filing Chapter seven or Chapter 13 bankruptcy.

It’s normally suggested to get a bankruptcy lawyer. The paperwork isn’t essentially that arduous to file, but the procedure itself might be tricky and you should Possess a lawful pro on your own aspect to ensure almost everything is going smoothly.

A bankruptcy trustee is assigned towards your bankruptcy situation to assessment the paperwork and search for non-exempt belongings that you might own.

You should choose two mandatory credit score counseling courses to accomplish your Chapter seven bankruptcy. The Chapter 7 trustee might request the certification of completion inside the Assembly of creditors. The very first program is really a pre-bankruptcy study course, and the 2nd may be the pre-discharge program.

The usa Trustee’s Office environment has accepted state-distinct corporations that offer bankruptcy courses. You are able to access a list of providers in Colorado giving bankruptcy programs to the US Trustee's Resources Web site. Each classes can be found on the net for a little charge.

A financial debt management prepare doesn’t lessen the amount of money you owe, nevertheless the credit score counselor may possibly be capable to get service fees waived or your fascination fee diminished.

To determine if your company is eligible for filing bankruptcy, it is necessary to grasp the specific criteria set forth for this method. Eligibility necessities for filing bankruptcy may vary depending on the sort of bankruptcy you are looking at.

After the meeting of creditors, the bankruptcy trustee will have sufficient information and facts to choose whether or not you hop over to here might qualify for Chapter seven bankruptcy.

Creditors are notified which they may possibly question the debtor queries. read the article That said, in every one of the 341 conferences I've attended, I haven't viewed a creditor show up.

Examine via the here outcome. If the thing is folks complaining of becoming cheated, then cross the company off your checklist.

May well thirteen, 2024 Do you know that in accordance with the U.S. Small Enterprise Administration, above 50% of little enterprises fall short inside the first 5 years? Dealing with enterprise bankruptcy may my company be a frightening prospect, but knowing the process and implications beforehand is essential.

Charlie Korsmo Then & Now!

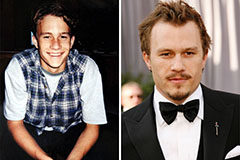

Charlie Korsmo Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!